Expert Tips on Getting Accepted for a Secured Credit Card Singapore

Expert Tips on Getting Accepted for a Secured Credit Card Singapore

Blog Article

Revealing the Opportunity: Can Individuals Discharged From Personal Bankruptcy Acquire Credit Score Cards?

Comprehending the Effect of Personal Bankruptcy

Personal bankruptcy can have a profound impact on one's credit rating score, making it testing to access credit report or loans in the future. This economic stain can stick around on debt records for numerous years, influencing the person's ability to safeguard favorable passion prices or monetary chances.

Moreover, insolvency can limit employment possibility, as some companies perform credit score checks as component of the hiring procedure. This can position a barrier to people seeking new task leads or career advancements. Generally, the effect of personal bankruptcy extends past financial constraints, influencing numerous elements of an individual's life.

Aspects Impacting Charge Card Approval

Getting a bank card post-bankruptcy is contingent upon numerous key factors that significantly affect the authorization process. One essential factor is the candidate's credit report. Following personal bankruptcy, individuals typically have a reduced credit rating due to the adverse impact of the bankruptcy filing. Bank card companies typically search for a credit rating that shows the candidate's capability to take care of credit scores responsibly. An additional vital consideration is the applicant's revenue. A secure income assures bank card issuers of the individual's capacity to make prompt repayments. Additionally, the length of time considering that the bankruptcy discharge plays an essential function. The longer the duration post-discharge, the a lot more beneficial the possibilities of authorization, as it suggests financial stability and responsible credit scores actions post-bankruptcy. Furthermore, the kind of bank card being gotten and the issuer's particular needs can likewise affect authorization. By meticulously considering these factors and taking actions to restore credit history post-bankruptcy, individuals can boost their prospects of acquiring a charge card and working in the direction of financial healing.

Steps to Restore Credit Rating After Bankruptcy

Reconstructing credit rating after personal bankruptcy requires a critical strategy concentrated on economic self-control and consistent debt management. One effective technique is to obtain a secured credit rating card, where you transfer a certain amount as security to develop a credit report limitation. In addition, take into consideration ending up being a licensed individual on a family members member's credit score card or discovering credit-builder financings to more improve your credit scores score.

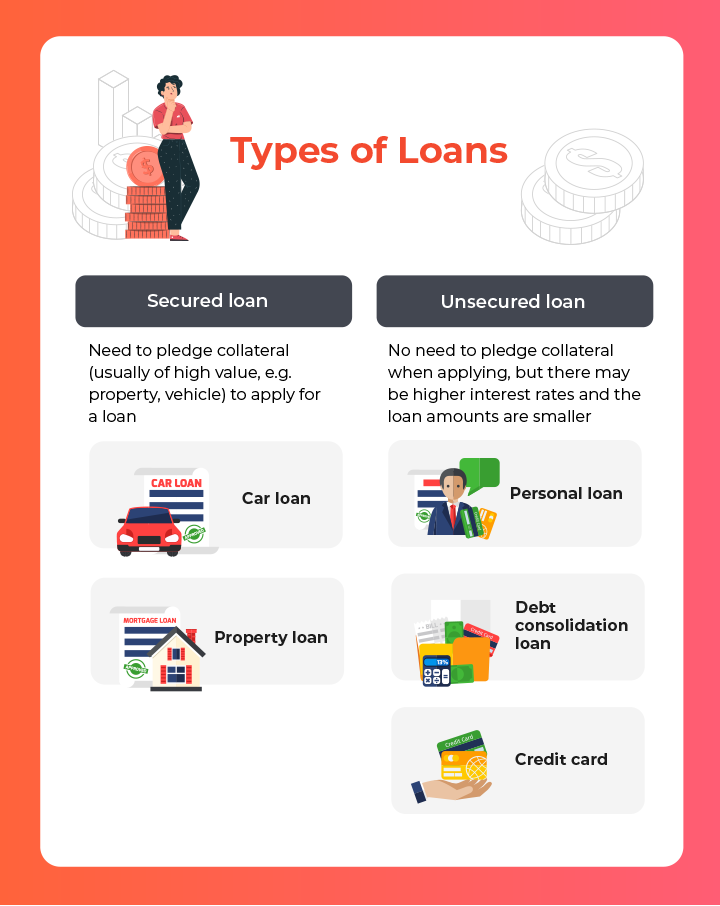

Protected Vs. Unsecured Credit Score Cards

Complying with insolvency, individuals often take into consideration the selection between secured and unsafe credit cards as they intend to reconstruct their creditworthiness and economic security. Protected credit scores cards call for a money deposit that offers as collateral, typically equivalent to the credit report limit provided. Eventually, the choice in between protected and unsecured More Help debt cards must align with the person's financial purposes and ability to take care of credit report responsibly.

Resources for People Looking For Credit Score Rebuilding

For individuals aiming to boost their creditworthiness post-bankruptcy, checking out available resources is critical to effectively browsing the credit rating restoring procedure. secured credit card singapore. One important resource for people seeking credit report restoring is credit scores therapy agencies. These organizations use economic education and learning, budgeting assistance, and customized debt improvement plans. By functioning with a credit report therapist, people can gain insights into their credit score records, find out strategies to increase their credit report ratings, and obtain advice on handling their funds properly.

An additional handy source is credit history surveillance solutions. These services permit individuals to keep a close eye on their credit rating records, track any type of mistakes or changes, and detect possible signs of identification theft. By checking their credit score on a regular basis, individuals can proactively resolve any type of issues that might make certain and develop that their credit report information depends on date and precise.

In addition, online tools and sources such as credit history simulators, budgeting apps, and economic literacy web sites can provide individuals with beneficial information and devices to help them in their credit reconstructing trip. secured credit card singapore. By leveraging these resources efficiently, individuals discharged from insolvency can take meaningful steps in the direction of boosting their credit health and protecting a far better financial future

Conclusion

To conclude, individuals released from insolvency may have the chance to obtain credit scores cards by taking steps to rebuild their credit scores. Elements such as credit debt-to-income, earnings, and history proportion play a considerable role in bank card authorization. By comprehending the effect of insolvency, selecting between secured and unsecured charge card, and making use of sources for credit a fantastic read history restoring, people can improve their creditworthiness and potentially acquire access to credit report cards.

By functioning with a credit rating counselor, people can gain insights right into their credit rating reports, discover strategies browse around this web-site to enhance their credit report scores, and obtain guidance on managing their funds properly. - secured credit card singapore

Report this page